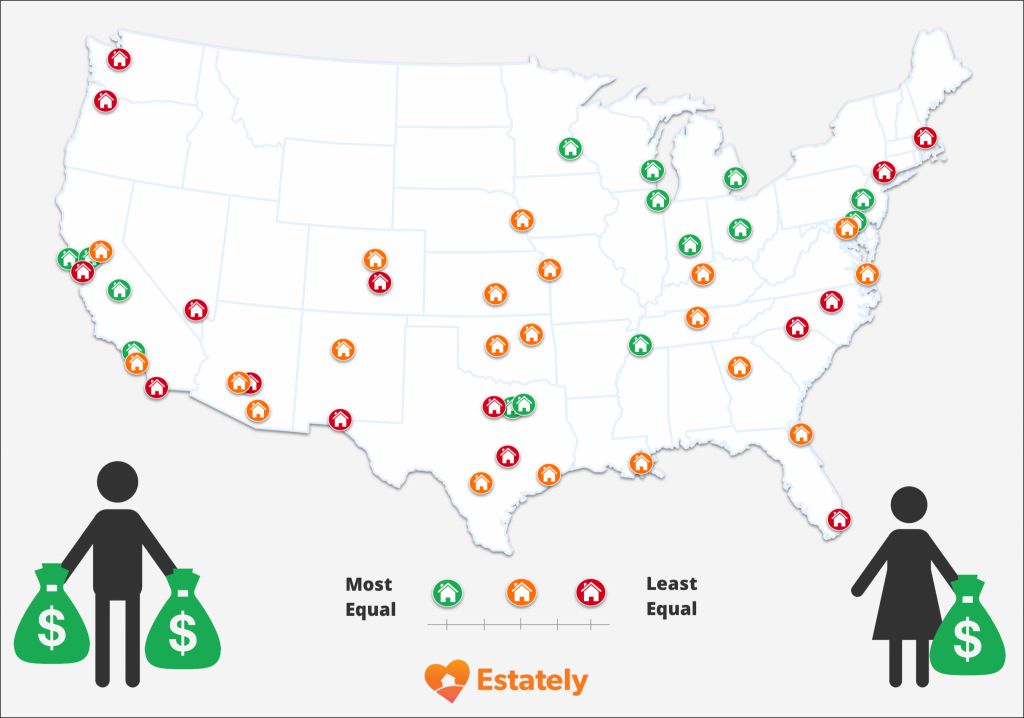

Where does the gender wage gap most affect equality in home affordability?

You can find report after report discussing the gender wage gap in the United States, with the most commonly reported figure being that women earn around 76 cents on the dollar compared to men. But what does this mean when it comes to buying a house? To find out, Estately used 2016 U.S. Census data to compare men’s and women’s median salaries in the 50 most populated U.S. cities. Based on these salaries, we assumed a monthly mortgage payment of 28% of the gross monthly income, then used a mortgage calculator to determine the maximum home price each salary could afford.

Next, we found the number of homes (including houses, townhouses, and condos) currently for sale in each city, and determined how many of the men versus women could afford at their median salaries. From there, we broke down what percentage of homes currently for sale men versus women can afford, and perhaps the most telling factor: how many more homes men can afford than women in each city.

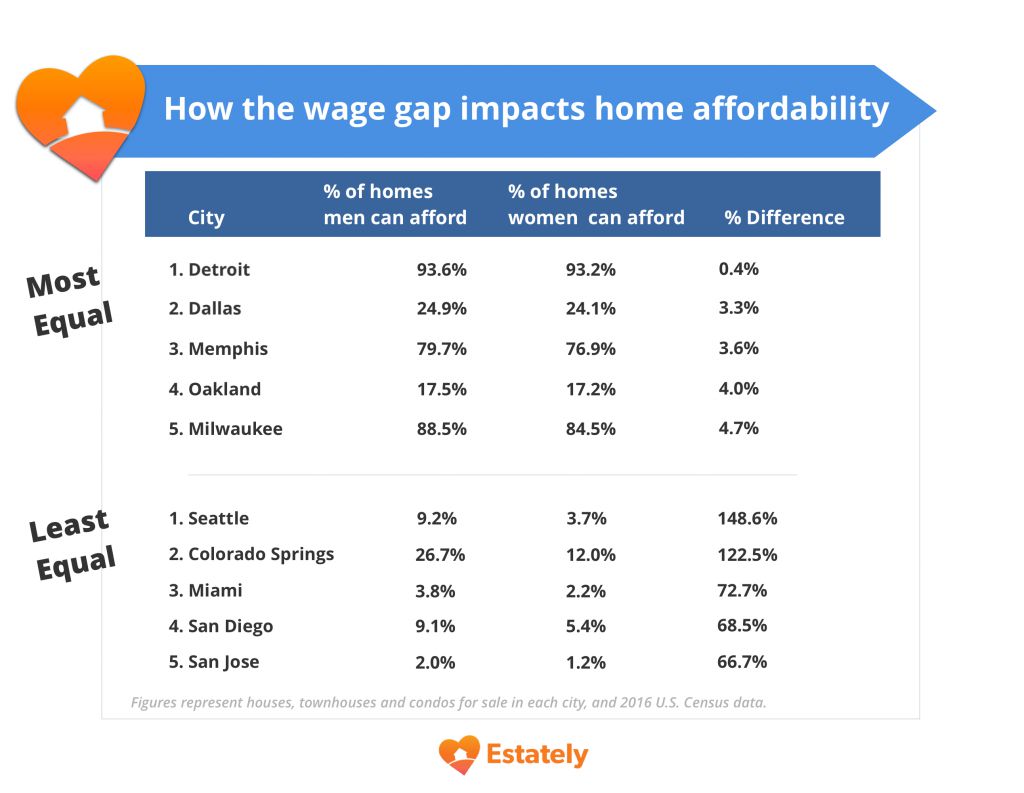

Some highlights:

- Seattle has the biggest wage-based housing gap. Men can afford nearly 150% more homes than women. The smallest gap is in Detroit.

- San Jose is the toughest city for median earners to purchase a home regardless of gender. Of the 244 homes for sale currently, the men’s median wage can afford 5 of them, and the women’s median wage can afford 3.

- Chicago has the biggest inventory for median earners of both genders. Men can afford 5,230 homes and women can afford 4,882.

How does your city stack up? Check out the chart below for the full report.

Curious about the salary data we used? Below, you can see men’s and women’s median salaries from 2016. Source: recently released U.S. Census data

| City | Men’s 2016 Median Salary | Women’s 2016 Median Salary | Difference |

| Seattle | $70,349 | $55,225 | $15,124 |

| Atlanta | $59,495 | $44,865 | $14,630 |

| San Francisco | $78,128 | $65,403 | $12,725 |

| San Jose | $65,878 | $53,641 | $12,237 |

| Colorado Springs | $50,392 | $38,797 | $11,595 |

| Wichita | $46,123 | $35,035 | $11,088 |

| Virginia Beach | $50,678 | $40,147 | $10,531 |

| Charlotte | $49,523 | $40,561 | $8,962 |

| El Paso | $39,219 | $30,480 | $8,739 |

| Washington, DC | $71,795 | $63,088 | $8,707 |

| Louisville | $45,250 | $36,849 | $8,401 |

| San Diego | $54,250 | $46,051 | $8,199 |

| Oklahoma City | $43,416 | $35,482 | $7,934 |

| New Orleans | $44,681 | $36,754 | $7,927 |

| Kansas City | $46,265 | $38,408 | $7,857 |

| Omaha | $45,684 | $37,888 | $7,796 |

| Tulsa | $41,037 | $33,472 | $7,565 |

| Fort Worth | $45,441 | $37,982 | $7,459 |

| Raleigh | $49,329 | $41,877 | $7,452 |

| Boston | $58,631 | $51,737 | $6,894 |

| Austin | $48,700 | $42,418 | $6,282 |

| Albuquerque | $44,444 | $38,252 | $6,192 |

| Mesa | $42,574 | $36,521 | $6,053 |

| Baltimore | $47,963 | $41,953 | $6,010 |

| Las Vegas | $42,595 | $36,825 | $5,770 |

| Indianapolis | $42,325 | $36,561 | $5,764 |

| Jacksonville | $42,156 | $36,443 | $5,713 |

| San Antonio | $39,831 | $34,143 | $5,688 |

| Memphis | $38,212 | $32,674 | $5,538 |

| Portland, OR | $51,336 | $46,106 | $5,230 |

| Chicago | $50,077 | $45,129 | $4,948 |

| Tucson | $37,098 | $32,208 | $4,890 |

| Houston | $40,926 | $36,167 | $4,759 |

| Columbus | $43,619 | $39,034 | $4,585 |

| Milwaukee | $40,129 | $35,701 | $4,428 |

| Miami | $31,671 | $27,246 | $4,425 |

| Arlington, TX | $42,232 | $37,916 | $4,316 |

| Denver | $50,105 | $45,886 | $4,219 |

| Phoenix | $41,316 | $37,143 | $4,173 |

| Philadelphia | $43,917 | $40,296 | $3,621 |

| New York | $51,003 | $47,416 | $3,587 |

| Sacramento | $46,628 | $43,286 | $3,342 |

| Long Beach | $46,356 | $43,045 | $3,311 |

| Minneapolis | $49,015 | $45,823 | $3,192 |

| Fresno | $39,518 | $36,410 | $3,108 |

| Nashville | $41,434 | $38,563 | $2,871 |

| Detroit | $33,618 | $30,984 | $2,634 |

| Dallas | $37,832 | $36,499 | $1,333 |

| Los Angeles | $40,364 | $39,414 | $950 |

| Oakland | $51,846 | $51,029 | $817 |

Estately real estate search is makes finding a home simple, easy, and efficient. Find your dream home now at Estately.com.